Forex Merchant Account Botswana

The term Forex is an abbreviation of foreign exchange. It’s also referred to as FX trading or currency market. In simple words, Forex or foreign exchange means the exchange of foreign currency. When a nation’s currency is exchanged into another nation’s currency in an established marketplace, that marketplace is called the forex market. There might be a question in your mind why it happens? Why would someone exchange the currency? The answer is demand, value and acceptance. Suppose a Motswana went to visit some European country. Now he wants to purchase some item; in what currency, a European shopkeeper will accept the payment? In Pula? No, the shopkeeper will accept the payment in euros. So where will he get the euros? The answer is Forex Market. He will have to exchange Pula for the Euro before visiting Europe.

Similarly, various nations'

governments exchange other nations' currencies for foreign trade. FYI, being

the most stable currency in the world, USD is the most exchanged currency on

one side. You know, the forex market is the world's largest and most liquid

market, with daily trade of $6.6 trillion. Earlier, the forex exchange was

limited to banks and financial institutions; later, it was open to individuals.

The rise of the internet and digital awareness plays a significant role in

expanding retail forex trading. Nowadays, billions of people are involved in

retail forex trading. Botswana is one of the leading countries where forex

trading is booming. This is high time a merchant must look forward to starting

its forex trading platform with the help of PayCly. To accept payment from

traders, you need a forex merchant

account and forex payment gateways linked with your

forex trading platform.

What is a Forex Merchant Account?

A forex

merchant account is similar to a bank account. It acts as a

traditional bank account, allowing you to accept, hold and withdraw the funds

received from clients. What? It acts as a bank account, then why am I not

taking a forex merchant account from a well-known bank? Some of you might know

the answer if you tried to get it from your bank. Let us make it clear to all,

Traditional banks and financial institutions do not provide you with a forex

merchant account as they consider forex a high-risk business.

But you do not need to

worry, as several payment service providers (PSPs) offer you a merchant

account. But, PayCly is the best of all as it customizes its forex

merchant account according to the need of Botswana

merchants. We tailor our services according to your requirements and do not

differentiate between regulated and unregulated, as we offer our services to both

merchants.

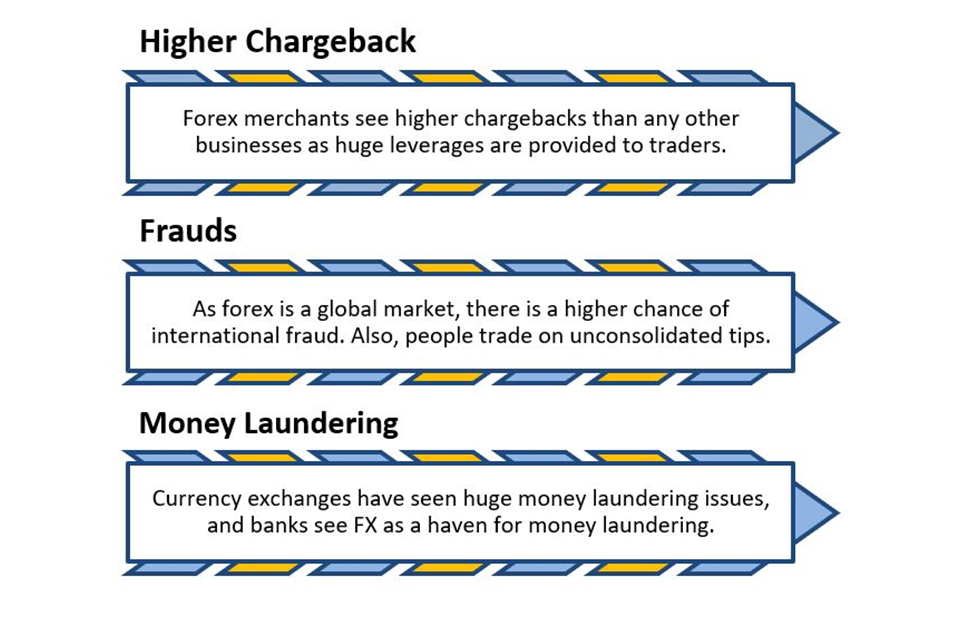

Why is Forex Business Considered High-Risk?

There are many reasons why

banks consider forex a high-risk business and do not provide a forex

trading merchant account; a few of them are mentioned here:

What Features a Forex Merchant Account Provider

must have?

As we know that forex is a high-risk

business and runs 24 hours a day. It needs some specific features so that the forex broker payment gateway and forex trading merchant account can fulfill

the merchant’s requirements. Some features we are highlighting here:

Alternative Payment Methods:

Forex is a global market. A

customer from any country can trade on a foreign exchange anytime. Nowadays,

there are numerous payment modes available, including credit cards, crypto,

etc. and every region and nation has its own choice of payment mode. A forex payment processing company must

offer its merchant as many payment modes as possible, including credit card processing for forex and crypto

settlement.

Multi-Currency Acceptance:

Multi-currency acceptance

is necessary for forex traders as people worldwide make trades in the forex

market. A customer makes an account on your app, and when he wants to add money

to a forex account, the local currency option must be given with the

alternative payment methods so that he can easily add and trade via your app or

web. A payment gateway for forex brokers must

accept payments in multi-currency; this facility helps increase customer

loyalty.

Chargeback and Fraud Prevention Tools:

The merchant must opt for a

PSP with strong fraud protection because the FX market has a higher chargeback

and fraud risk than other markets. A PSP must offer anti-fraud algorithms and

systems that recognize, evaluate, and ascertain fraudulent transactions in

order to strengthen the security of a merchant's account.

Quick Single-Click Payment

Every

millisecond counts on the currency market. Transactions must be completed

instantaneously without delay in the forex market, where currency rates are

constantly fluctuating. One-click transactions encourage customers to

trade more and boost loyalty toward the merchant.

Round-the-Clock Customer Support:

As the forex market works

around the clock, a forex trading merchant account provider must

provide 24-hour customer assistance. Customer support should be available in

multiple languages and respond appropriately and timely to any difficulties.

Advantages you get by acquiring PayCly’s Merchant Account

Benefits of PayCly’s Forex Merchant Account

Conclusion

We’ve seen several factors

of the forex market, and we are now all aware of what features a PSP must offer

in a forex merchant account and forex payment gateway. After analyzing

many forex payments processing firms, we concluded that PayCly is what you all

need. One of the best things PayCly has is that we consider a merchant its

partner, not a client. We tailored our services according to your requirements.

Our forex merchant account is a perfect blend of international payment

gateway and high-risk merchant account, as both features are essential for

forex business. We suggest you choose PayCly. For further info, please visit us

at https://paycly.com/.

Frequently Asked Questions (FAQ)

What are the Differences between Payment Gateways

and Merchant Accounts?

A payment

gateway is a system that makes payment transactions by securely sending

payment information. A merchant account, however, functions more like a bank

account and takes, holds, and withdraws the funds credited by the

customer. PayCly provides a comprehensive range of payment solutions,

including international payment gateways and high-risk merchant accounts.

What Other Payment Solutions Does PayCly Provide in Addition to its

Payment

Gateway?

PayCly offers each and

every payment solution that your company needs. We provide a comprehensive

range of payment services, including high-risk merchant accounts, offshore

merchant accounts, and credit card processing (card not present payment), in

addition to payment

gateways. All regulated and unregulated businesses are supported by PayCly,

and we've created a few merchant accounts with high-risk qualities and

industry-specific functionality. We have extensive expertise in offering merchant

accounts and payment

gateways to the following industries:

|

E-Commerce

Merchant Account |

Fantasy Gaming

Merchant Account |

|

Escort

Merchant Account |

|

|

E-Cigarettes

Merchant Account |

|

|

Tobacco

Merchant Account |

SMM Panel

Merchant Account |

Comments

Post a Comment